working in CSI environment

Thursday, May 17, 2018

General instructions for working in CSI environment-reg.

This is regarding General Instructions to be followed for working in CSIenvironment.The Head of the Offices are hereby directed to strictly follow the following instructions for proper functioning of offices in vigilance angle until further orders.

At Post Office level:

Daily account submission to Account Office:

1. A Manual Rough book of SO and its BO's should be maintained on day-to-day basis.

2. CSI System Generated Sub Office Daily Account along with TCB and BO Manual Daily Account and BO daily account generated in CSI environment should be sent to its Account office along with the vouchers and reports through Account bag without delay.

3. At the end of the day POS cash should be zero and physical cash should tally with DOP Cash i.e, the daily account closing balance and DOP cash closing balance should be tallied. POS cash balance Zero at the end of the day can be checked by using T-Code ZFI_POS_BAL in SAP module. .

4. In cases where there is non-reflection of heads in daily account due to sync issue, the heads shall be manually incorporated in daily account and sent in account bag. A separate error book should be maintained. This is applicable for B.O daily account also.

5. The opening and closing balances should be carry forwarded correctly. If any discrepancy happens, the same should be recorded in error book.

Cash reversal issue:

6. If the issue of non tallying of daily account is due to irregular posting (for example, posting the same document twice in ZBF07 menu), mail should be sent to HO Posmaster with the subject as “CSI CASH REVERSAL ISSUE” along with the details of the irregular posting made.

7. The HO Postmaster should proceed with the reversal after ensuring genuineness from the concerned branches of HO and this irregularity by any SPMs should be reported to concerned Divisional Office.

Technical Issue:

8. If the daily account is not tallied due to technical issues, the same should be sent as mail to concerned Divisional office with the subject line "CSI DAILY ACCOUNT ISSUE". The tickets for the same should be raised only by the Divisional IT team.

Bills paid vouchers:

9. While making Bills paid and other payments, correct GL code should be used. In thisregard for any clarification, Head Post Office/Divisional Office accounts staff should be consulted before making payment. Without having correct GL Code, no payment should be made.

10. System generated document number and corresponding GL code. Head of Account should clearly be noted in each and every voucher without fail.

eMO:

11. The PM/SPMs should ensure that the eMOs are booked & accounted properly and the same should cross verify with eMO issue list. The transmission of eMOs to central server should be confirmed with eMO MIS to avoid public complaints.

12. All accountable articles and eMOs should be disposed properly. Any issue should be entered in error book and reported to D.O with the subject "CSI DAILY ACCOUNT ISSUE".

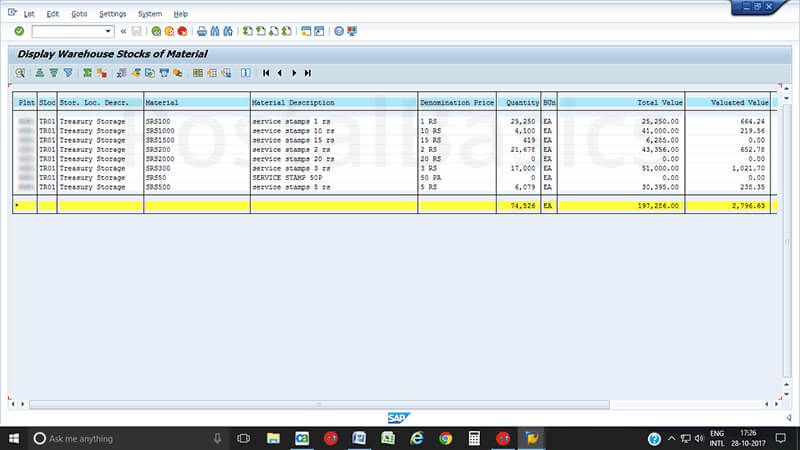

13. The PM/SPMs should ensure that eMO is not generated in duplicate to avoid double payment and the same should cross verify with eMO paid list.

Cash request and Cash payment:

14. Offices requesting cash should note the document number in the requesting document / letter. While requesting cash, requesting office should mention the office name in the remarks to Identify the office name easily.

15. While accepting cash from Cash Office at receiver end, the document should post and give complete work item in Inbox to avoid cash in transit.

16. Post office should adjust the transit on daily basis. HO should adjust the transit for remittance made to S.Os and cash received from S.Os. SPMs should do the same procedure for S.O to B.O flow.

BO Stamp sales:

17. The BOs should be instructed to account the stamp sales in the receipt side of BO daily accout and educate to maintain the stamps in Stamp Register instead of maintaining Stamp Balance.

BO Daily Account:

18. The SPMs' will please ensure that all the BO transactions are incorporated in the concerned BO daily account. System Generated BO daily account should be sent to the concerned Branch Office the very next day without fail.

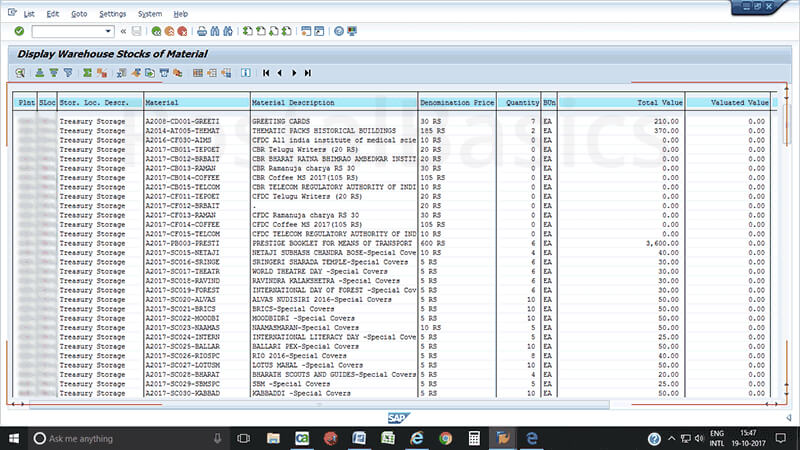

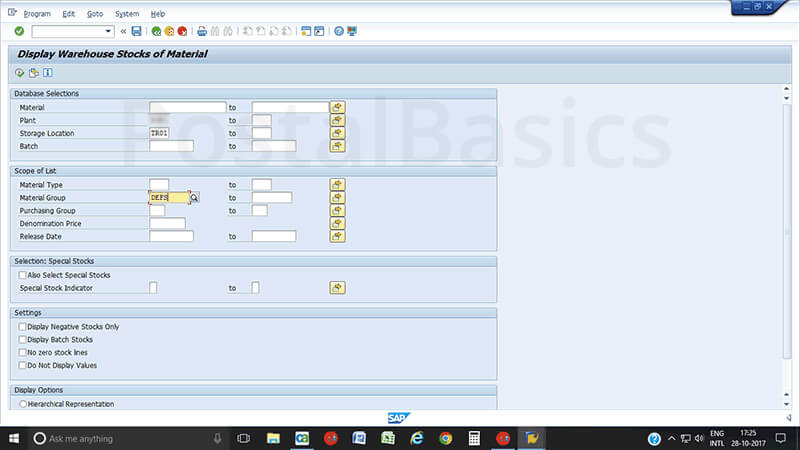

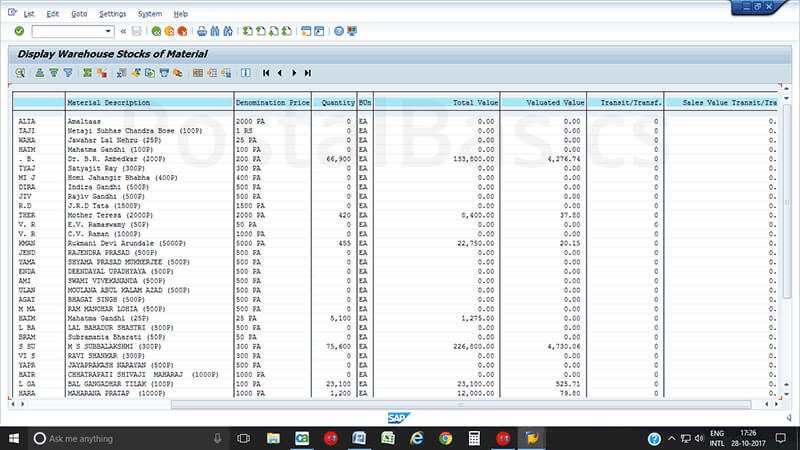

Treasury:

19. Whenever any entry is made in the SAP, document number should be noted in the Hand-to-hand / Treasurer book.

Figures to be noted in CSI generated Daily account:

20. In case, Cash flow issue persists on next day also, necessary entries should be mademanually in the System generated SO daily account and tallied Daily account should be sent to its account office.

21. Report on material balance viz Stamps, IPO, etc., should be submitted to account office along with daily account.

Wrong Posting:

22. Posting of vouchers and other transactions in F-02/Bulk Upload option should be done with extreme care. Proper caution should be made while posting SO transactions and BO transactions i.e., use POS application for SOs related transactions and browser for BO related transactions and for Mccamish, use BO user ID.

23. If any duplication/wrong posting of voucher & other transactions is done, it can be reversed only by the HO Postmaster with the approval of Divisional Head and hence posting should be made cautiously.

24. In event of wrong postingerror entry should be recorded by Sub Office SPM and extract should be sent to the Post master of the concerned Head Post Office for reversal. SPM should submit request with subject as "CSI Document Reversal" alongwith Genuiness certificate to the HO Postmaster for obtaining approval from the Divisional Head.

25. Moving credit/debit to unnecessary GL Head is not allowed. If any such entry is found, severe action will be taken on the defaulted official.

26. SMR should be prepared manually and sent to Head Office on monthly basis as per existing instructions.

27. Preparation of ECB memo should be done manually and submitted to its Account Office as per existing instructions.

At Head Post Office level:

1. CSI System Generated Sub Office Daily Account along with TCB and BO Manual Daily Account and BO daily account generated in CSI environment should be sent to its Account office along with the vouchers and reports through Account bag.

2. The Sub Account branch of every HO shall function in usual manner. MM Software cannot be used. The Sub Accounts PA, on receipt of account bag, will check if thesupporting documents have been received for all the headsincorporated in Daily Account and hand over the documents to the concerned branches.

3. The Sub Accounts PA shall maintain record of OB and CB of all the facilities, under that HO separately (Sub office, branch office and BPC in excel format).

4. Cash remittance details should be maintained for all the Facility Centres including Sub Offices, Branch offices and BPCs under the division In excel format. Correctness of CB in Daily Account and TCB should be ensured.

5. The Sub Account PA should ensure that the previous day closing balance is tallied with next day opening balance In all the Facility Centres. In case of any adverse issues, it should be raised to the concerned facility centre with a copy marked to D.O with necessary error entries.

6. Accounting of cash remittance should be cross checked with daily account of theconcerned Office.

7. Sub Account PA will check whether POS Cash Balance is zero by using TcodeZFl_POS_BAL for HO/AN SOs under that Division. Necessary error entries should be raised to concerned facility ID to make POS cash balance into zero.

8. Consolidated ECB Memo received from Sub Offices should be submitted to Divisional Office.

9. T code for General Ledger View is FAGLL03. The officials in accounts branch and SBCO shall use FAGLL03 menu to check if the vouchers have been posted correctly in the concerned heads. Any discrepancy in the postings should be maintained in a register and necessary action shall be taken by the Postmaster to settle the discrepancy. A monthly consolidation of each head shall be generated using FAGLL03.

10. The Pay and allowances for Departmental, Extra Departmental and Outsiders should be credited to their SB account at HO.

11. The salary credit and any other payment made to departmental, extra departmental - employees and pensioners shall be given SB Credit at HO so that there will be no issue in head of accounts. For other individual rolls, the SB credit shall be given at counters with Bills paid adjustment. The accounts branch should mention the head of accounts in each roll.

12. For salary payment made to stop gap officials and substitutes, the SDIs will give the list of officials with the SB account number duly attested. The accounts branch will upload the salary in the same method as department employees.

13. Invoice should be created for each and every payment to the vendor by using Tcode FB60 before initiating payment by the treasurer.

14. All kind of vouchers of the concerned facility centre should be checked withcorresponding GL Code In SAP module & tallied accordingly.

15. Finade and McCamish transactions should be checked in SAP module and verified with the consolidation statement.

16. In event of wrong posting made the Facility centre, Genuiness certificate should be obtained from the concerned SPM. After obtaining the reversal request along with Genuiness certificate from the SPM, the genuiness of the same should be ensured before submitting request to DO for approval.

17. A separate register should be maintained for Reversal process and each entry should be recorded.

18. AcquitanceRoll(AR) prepared at Accounts branch should be checked to ensure that it is accounted correctly in the corresponding GL code.

The above general instructions should be scrupulously followed till receipt of detailed SOP from CO/Directorate.

![eMO paid list Generation- An ultimate solution [CSI - DPMS] eMO paid list Generation- An ultimate solution [CSI - DPMS]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEi7giFgvJRNNUSekvUCdl5IOEadP3CkDq-88YpOeyAl69CPoESDZcklTyXAeNscmhxBNjFKBmlOB5CmeDRzJFK-nC3Pac6HlOMTORM1b5wd_zRWiI3aBRf40teiQPSVt3dFcO3chwrcqto/s1600/eMO+Paid+List+in+CSI+Environment_potools.png)